Transport Industry Entrepreneurs: Protect Your Business

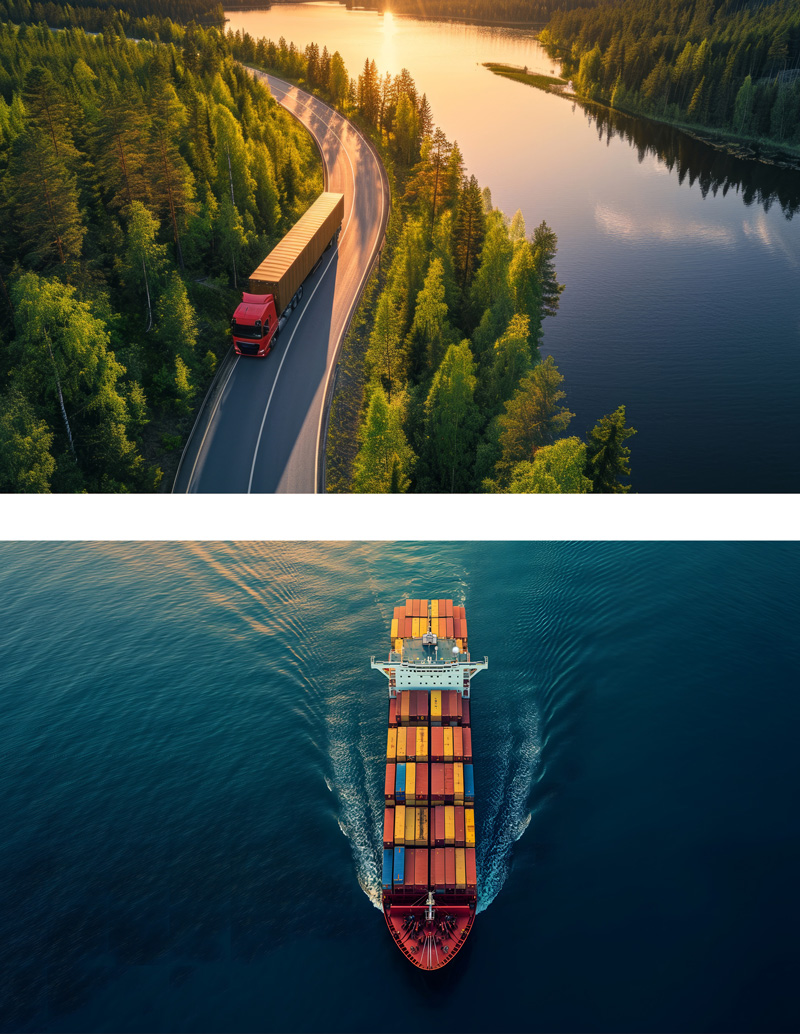

As a transport industry entrepreneur, each shipment represents much more than just moving goods. It is a commitment to your clients, a promise of reliability.

Whether you are in land or marine transport, we understand the challenges you face and offer tailored protection to ensure the continuity of your business against unforeseen events.

The Different Types of Transport We Insure

Land transport

Land transport includes road and rail transport. It is one of the most commonly used methods for short and medium distances.

Examples:

- Passenger transport (taxi services, school transport...)

- Livestock transport

- Vehicle transport

- Transport of oversized loads...

Specific risks: road accidents, theft, damage during loading and unloading.

Marine transport

Marine transport is often used for large-scale international shipments. It allows for the transport of large quantities of goods at a lower cost.

Example: container transport

Specific risks: shipwrecks, damages, theft at sea, and weather-related damages.

Flexible Insurance Protections

Every transport business has unique insurance needs. At Assurancia Groupe Tardif, we offer a range of flexible coverages tailored to your specificities. Here is an overview of our solutions.

Perishable cargo

Specific for perishable goods, covering losses due to deterioration during transport.

Theft

Specific protection against theft during transport to ensure the safety of your cargo.

Delay

Covers financial losses due to delays in the transport of goods.

How to Choose the Best Transport Insurance for Your Needs

Evaluate your needs: Identify the types of goods you transport and the associated risks.

Contact your broker: Your broker will help you find the coverage that offers the best value for money.

Frequently Asked Questions

What types of goods can be insured?

Most goods can be insured, including perishable products, hazardous materials, and high-value items. Consult your broker for specific details.

What should I do in case of loss or damage?

Immediately contact your broker, provide the necessary documents, and follow the instructions for the claims process.

How are transport insurance costs calculated?

Costs vary based on the value of the goods, the type of coverage chosen, and the associated transport risks.

Can I modify my insurance coverage during the contract term?

Yes, most brokers allow adjustments to your coverage based on your evolving needs.