Choose coverage that suits your needs

To benefit from the best protection, take the time to study the different options of your auto insurance contract.

In addition to third-party liability, which is mandatory, options are available to protect damage caused to your vehicle (collision, theft, fire, etc.) or for specific needs (replacement insurance, etc.).

To have solid protection adapted to your needs, ask your questions to your broker:

- Is my civil liability protection sufficient to drive in the USA?

- What is the amount of my deductibles?

- What is excluded from my contract?

Your automobile insurance broker is there to assist you.

What our clients say

Excellent customer service, thank you Claudie Proulx.

Sylvain C (Google Review)

Succursale de GatineauService that meets my expectations with respect and courtesy.

Gilles T (Google Review)

Succursale de GatineauVery good service and competent broker.

Nicolas M (Google Review)

Succursale de Quebec

Understand your auto insurance policy

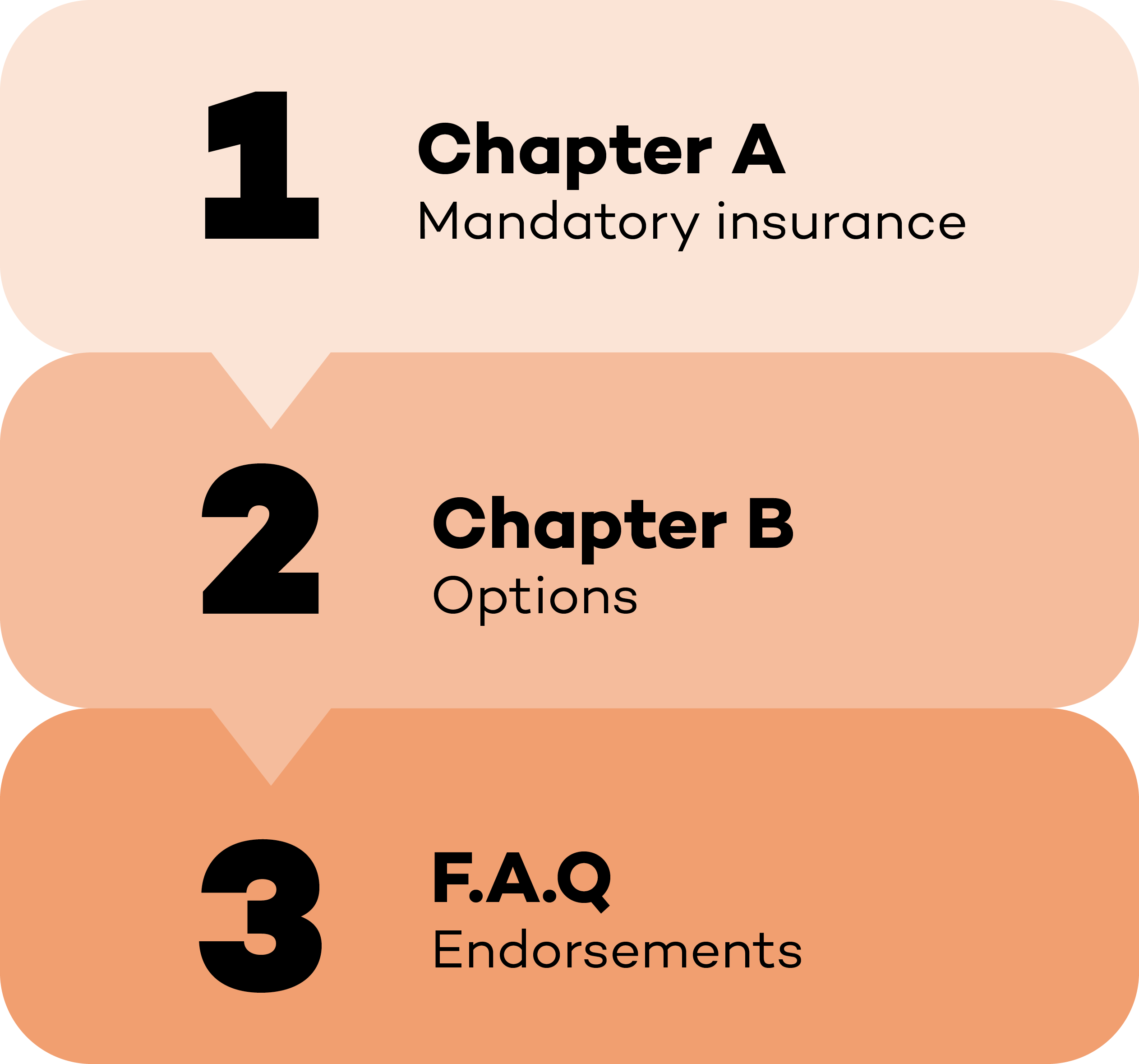

The car insurance contract is standard between all insurers so that it is understandable by all insured. It is organized into three parts:

Part 1 called “Chapter A”: covers civil liability insurance (mandatory insurance). In this chapter, you will find the amount of your civil liability.

Part 2 called “Chapter B”: includes the different options for damage to your vehicle (collision, fire, theft, vandalism, glass breakage, etc.).

Part 3 called “F.A.Q” (Quebec Endorsements Form): includes endorsements, and additional protections (replacement insurance, etc.).

Your automobile insurance broker is there to advise you and help you understand your contract

How can you save money with your insurance policy?

Contact your broker to find out about all the discounts available.

Auto and home

By bundling auto and home insurance, you save money.

Multiple vehicles

Discount when you insure more than one vehicle belonging to members of the same family/same household.

Group Plan

Does your organization have a group plan with Intact? You are eligible for the rate negotiated by your organization.

Electric vehicle

Drive an electric vehicle and obtain a discount on your auto insurance

Information to transmit to your broker for a quote

For your broker to be able to make the most accurate quote possible, you must provide him with the following information:

- DETAILS OF THE CAR TO BE INSURED

Year, make, model, estimated annual mileage, date of purchase/lease of the vehicle, number and description of violations and claims....

- INFORMATION ON THE INSURED

First and last name, address, driver's license number, year of license, etc.

With your agreement, we will question the credit agency to be able to make you the best possible offer. Be aware that this does not affect your credit rating.

Having problems finding insurance?

Trust us, Assurancia Groupe Tardif specializes in second chance insurance and has a team dedicated to finding solutions for you!

The following are examples for which Assurancia Groupe Tardif can assist you in finding coverage for your car:

Non-payment of premiums

Criminal record

Claims frequency

Interrupted insurance contract

Employment related issues

Difficult financial circumstances, including discharged bankruptcy

And many more…

Frequently Asked Questions

What does it mean: auto insurance premium, auto insurance policy, deductible, certificate of insurance?

Insurance premium: amount to be paid to be covered by the insurer for the duration of the contract.

Insurance policy: a contract (policy) in which an insurer indemnifies another against losses from specific perils

Deductible: It’s an amount you must pay in the event of a claim. In certain situation the deductible will not apply.

Certificate of insurance: It’s a proof of insurance to have in your possession. (known as a pink card).

What is the difference between the public insurance plan and the private insurance plan?

The public plan of the Société de l’assurance automobile du Québec (SAAQ) covers bodily injury.

Private insurance covers material damage caused or suffered by the insured and bodily injury caused to another person that is not covered by the SAAQ.